Financial Accounting System

eXert

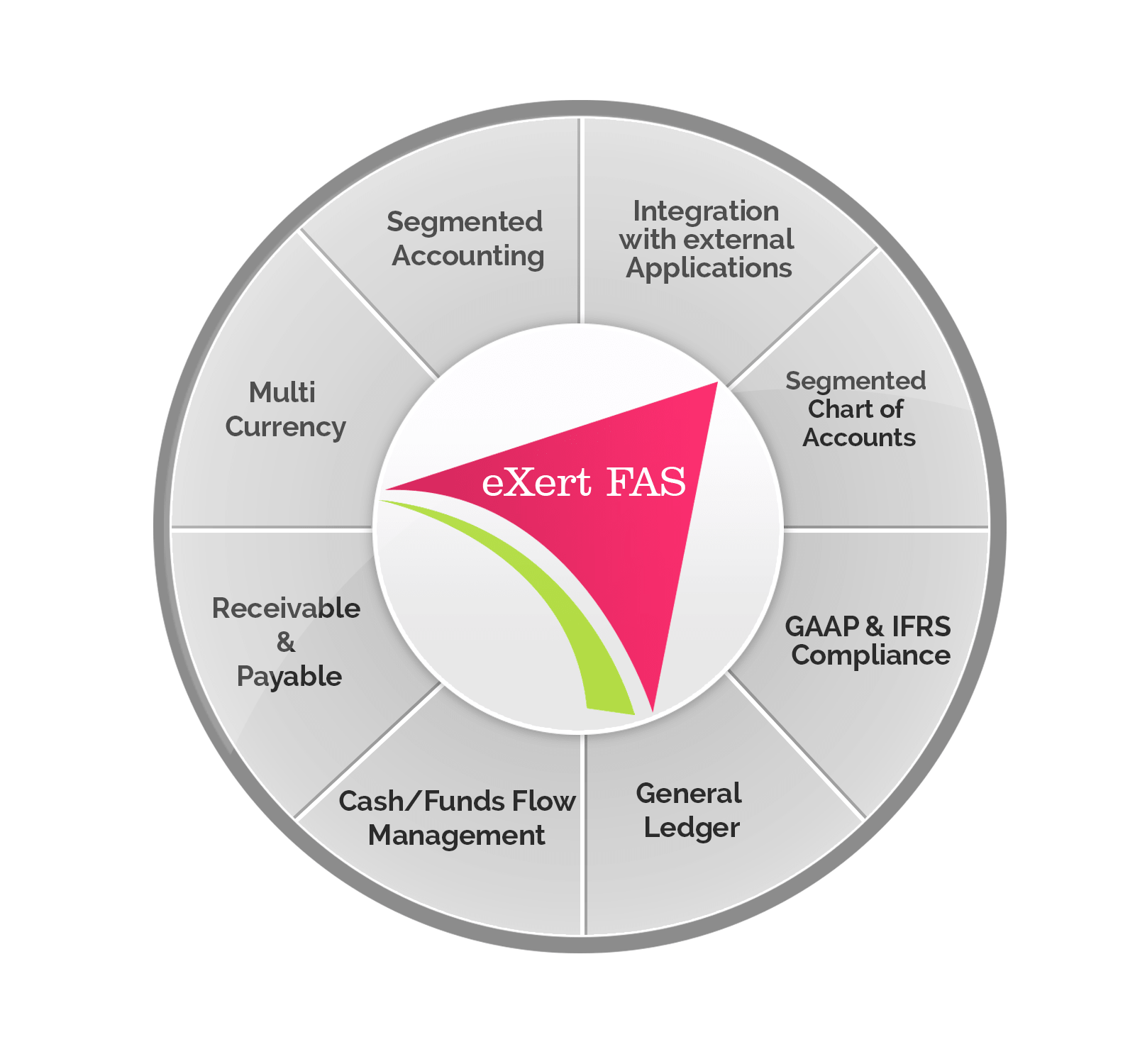

Financial Accounting Software Plans, directs, and coordinates accounts, investments, segment issues, tracings, reporting, and other financial activities of a location, office or a region of an establishment. eXert Financial Accounting System encompasses full range of organization’s finances by defining sequence of steps. The term "eXert" means that this approach to financial management has a long-term horizon. A Small and medium enterprise to a multi department enterprise with huge infrastructure entirely depend on an financial ERP for processing, maintaining and auditing their financial status and structure. eXert Financial Accounting Software is one of a kind programmed system to achieve financial due diligence and controls.

eXert Financial Accounting System processes, maintains and audits the financial status and structure of an organization. eXert Financial Accounting Software sets objectives, identifies resources, analyzes data and makes financial decisions to track the variance between actual and targeted result. eXert Financial Accounting System is built for small, medium and multi branch/department enterprise.